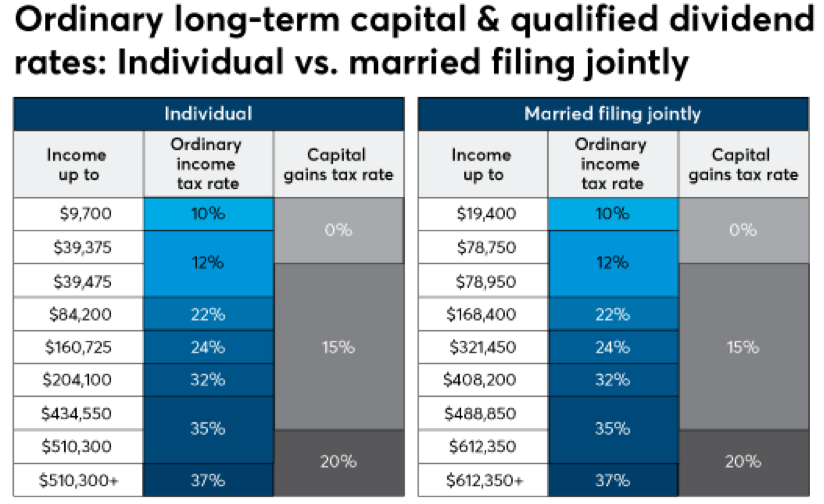

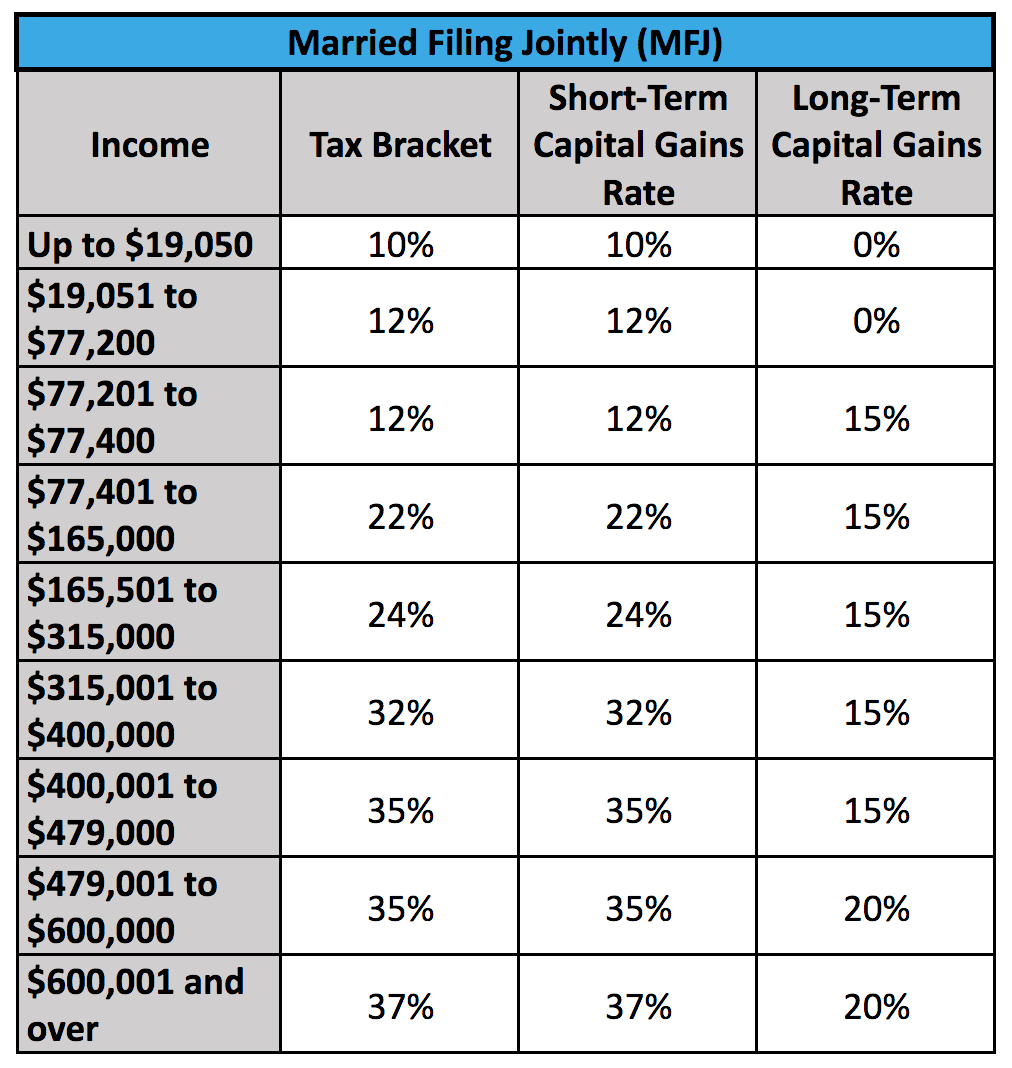

This avoids creating situations where you'd be better off earning/making less. Capital gains rates for individual increase to 15 for those individuals with income of 40,001 and more (80,001 for married filing joint, 40,001 for married filing separate, and 53,601 for head of household) and increase even further to 20 for those individuals with income over 441,450 (496,600 for married filing joint, 248,300 for marri. Other sold assets will be taxed at long-term capital gains rates. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for long-term capital gains) is.

Long term capital gains tax brackets 2020 how to#

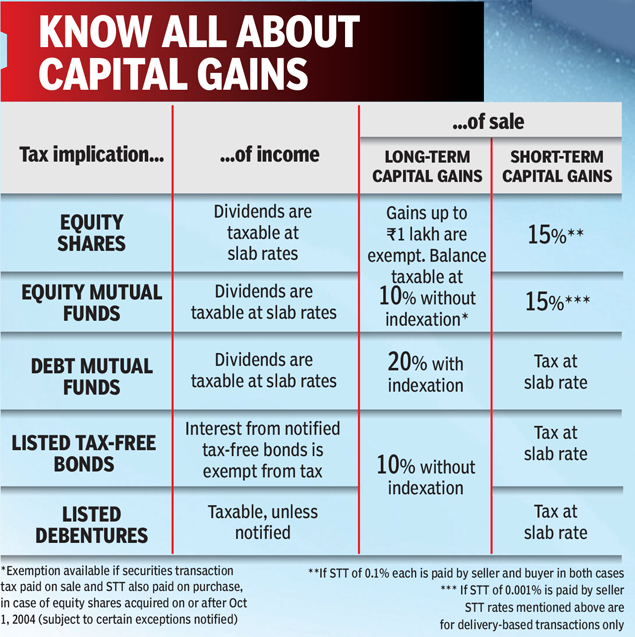

Any asset held for less than a year is considered short term and is subject to a different capital gains structure, usually ordinary income. Short term capital gain tax How to calculate Capital Gains on Shares What is Capital Gains Tax Union Budget 2020-21- 10 tax levied on long-term capital. The tax rates in each bracket only apply to the dollars in that bracket. There are two types of capital gains: long-term and short-term. In addition to having a progressive tax system, the US system also (in general) does not discourage you from making more money. The capital gains tax rate is 0, 15 or 20 on most assets held for longer than a year. It would be a progressive tax regardless of whether or not all of your capital gains were subjected to the higher rate. By virtue of having tiers with higher rates for higher incomes it is progressive.

Just to clarify, a progressive tax just means the more you earn/make the higher the rate you pay. In your example (assuming you file single) you'd pay 0% on the first $20,400 ($20,000 in 2020) of long-term capital gains and 15% on the remainder. Yes, you can have portions of your long-term capital gains taxed at different rates if adding your long-term capital gains to your other taxable income causes your total income to span multiple capital gains tax brackets. Any of the special recapture values get reintroduced between line 21 and 44. The value in line 21 is crossreferenced to a tax table to calculate the tax due in line 44. The tax brackets that set the tax rates for capital gains and dividends are determined by level of taxable income. The IRS just announced how long-term capital gains in 2020 will get taxed, and in many ways, it looks a lot like it did in past years. rate for long-term capital gain income, most states tax all capital gain. Your example is not stipulated to have variables such as dividends, the 28% and section 1250 recapture, investment interest, and other modifications that impact these values, so the value in 7 should flow to box 9, 10 and 13: 40,000īox 14 subtracts box 13 from box 1. For our purposes here, capital gains income refers to income from long-term capital gains (those assets held for over a year). State and local individual income tax revenue collections in 2020 were slightly. Which rate your capital gains will be taxed depends on. Your total long term capital gains from Schedule D goes in box 7: 40,000. The three long-term capital gains tax rates of 2019 havent changed in 2020, and remain taxed at a rate of 0, 15 and 20.

Your total taxable income after standard deduction and including the gross capital gains goes in box 1:(32,500+40,000-12,500) = 60,000. instead of the annual exclusion, the exclusion granted to individuals is R300 000 for the year of death.įor more information see Capital Gains Tax (CGT).I recommend you work out the Schedule D worksheet (page 16 and 17 at this IRS instruction PDF).small business exclusion of capital gains for individuals (at least 55 years of age) of R1.8 million when a small business with a market value not exceeding R10 million is disposed of and.annual exclusion of R40 000 capital gain or capital loss is granted to individuals and special trusts.

0 kommentar(er)

0 kommentar(er)